Do I Need A Registered Agent For My Corporation In California

More than Near Professional Corporations

How does a professional service course a business organisation?

You have worked hard—you put in the schooling, the testing, the practice. Finally, yous have received your license to practice in California, and you are ready to start your business organisation! So, you start taking the steps to form a concern entity.

Or maybe you are a business person who wants to invest in a corporation that will be operated by a professional person. You don't know how and don't care to actually be a doctor, dentist, or lawyer—but you desire to help run the business and grow it. You are set to invest with a professional person who does have the skills and license to form your own business organisation entity in this field. Tin you practise information technology all? What are your options?

In either scenario, as yous start to set upwards the business you volition begin by considering different entity' choices. You lot've heard of an LLC and an LLP, you've heard of an S-Corp and a C-Corp, simply you lot're not quite sure how and where a Professional Corporation fits into the movie. Whether you are practicing the profession or only want to share in the buying of such a business concern, understanding a professional corporation tin can be the difference between a wasted investment and failed business concern or a successful and legal corporation.

What Is a Professional person Corporation?

A professional corporation is a corporation that provides professional services in a single profession and is organized under the Full general Corporation Law. In many instances, the rendering of their services is provided legally in accord with a document of registration that is issued past the regulatory governmental agency for the profession. The practice or business of this profession under a document designates itself as a professional or other corporation.

Chiropractic is a expert example. There are multiple steps to the process. If you desire to practice chiropractic, y'all can't just put an adjusting tabular array in your garage and tell everyone from the neighborhood to come for an adjustment—legally anyway. What you lot need to practice is become to Chiropractic School and sit through all the Chiropractic boards. And if you successfully pass the boards—you lot have to obtain a license to practice Chiropractic from the California Lath of Chiropractic Examiners—the regulatory governmental agency for the profession. This is followed by forming a professional person corporation and so applying for a Document of Registration from the Board.

So, what does Professional Services mean?

"Professional services" refers to any type of professional services that requires certification, license, or registration authorized past the Business concern and Professions Lawmaking, the Chiropractic Deed, or the Osteopathic Human activity in social club to be carried out legally.

What does a "Licensed Person" mean?

It ways a person who is licensed under the provisions of the Business and Professions Code, the Chiropractic Act, or the Osteopathic Deed to return the same professional person services as will be rendered by the corporation of which they are, or intend to become, an officer, director, shareholder, or employee.

Does every professional person have to obtain a Certificate of Registration from their Board in California?

Non necessarily. Professionals that are not required to obtain a certificate of registration to offer their professional person services when operating a corporation are those licensed by the following boards:

- Medical Board of California or any examining commission nether the jurisdiction of the board;

- Osteopathic Medical Board of California;

- Dental Board of California;

- Dental Hygiene Committee of California;

- California State Lath of Pharmacy;

- Veterinarian Medical Board;

- California Architects Board;

- Court Reporters Board of California;

- Board of Behavioral Sciences;

- Speech-Linguistic communication Pathology and Audiology Board;

- Board of Registered Nursing; or the

- State Board of Optometry

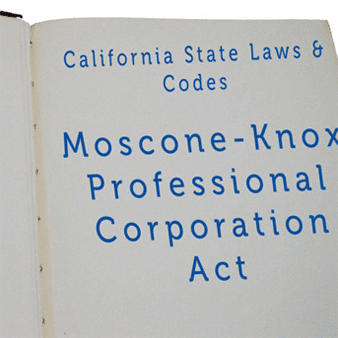

Is there a specific California state law that deals with professional corporations in California?

Yes, there are quite a few but the main ane is known as the "Moscone-Knox Professional person Corporation Human activity." Information technology can be located in the California Corporation Code. Considering there are many other laws that deal with professional corporations, working with a lawyer familiar with these laws is critical in making sure all your bases are covered.

Once you lot are licensed and want to form a corporation to practice/run your business—information technology cannot be a General Stock Corporation. In the state of California, professionals who wish to perform their professional person services and practice information technology using a business entity are REQUIRED to form a Professional Corporation.

Hither is a list of the dissimilar types of Professional Corporations in California:

The Difference betwixt an LLC and a PC (Professional Corporation)

Essentially, the difference between an LLC and a PC comes down to the laws: what are you allowed to form for your business?

Can I form a limited liability company for the purpose of rendering professional services?

This limitation is fix out in the California Revised Uniform Limited Liability Company Act. In California Corporations Code 17701.04(e) it states:

"Null in this title shall be construed to permit a domestic or foreign express liability company to render professional services, every bit defined in subdivision (a) of Section 13401 and in Section 13401.3, in this land."

Similarly, y'all would be restricted in forming a general partnership to operate your professional person business with a non-licensed private.

Every bit a licensed professional in California, yous may organize your individual practice either as a sole proprietorship, professional corporation, or a registered express liability partnership.

Does a Professional Corporation protect my personal assets from malpractice?

Professional corporations do not provide a professional with malpractice liability protection for their ain negligent acts, but they can protect the professional from liability for the negligence of other owners. Moreover, professional corporations besides provide express liability protection for certain other claims (e.grand. if somebody is injured at your place of concern).

What prevents me from forming a Professional Corporation?

The almost obvious answer here is if you practice non have a license or are not legally permitted to do that profession. However, this question can besides extend into ownership of a company. Only certain licensed individuals can ain or be shareholders of a professional corporation, even if that individual is non performing whatever of the professional person services. Bank check out this story about a client we had who was not enlightened of these specific requirements for professional corporations:

What if I don't want to share ownership in my Professional person Corporation, but rather I want to employ a related private for the professional person service (such as a medical professional)?

Even if you only desire to employ an individual in your professional corporation, that individual needs to exist licensed (as mentioned in Division two of the Business and Profession Code, the Chiropractic Act, or the Osteopathic Act) and you lot need to meet the requirements to course a Professional Corporation for them to render professional services.

I had a license earlier only have been disqualified. Am I still able to operate inside the requirements for a Professional Corporation?

If you did accept a license and and then go a disqualified person, you are ineligible to remain as a shareholder, director, or officer of the Professional person Corporation.

A "Disqualified Person" means a licensed person who for any reason becomes legally disqualified to render those professional services. This tin can exist temporary or permanent and relates specifically to the particular professional person that the corporation or foreign professional corporation of which the private may be an owner, shareholder, or employee.

Forming a Professional person Corporation: Express to One Profession

When you form a Professional Corporation in California, you must country which specific profession your company/corporation will be practicing in the Manufactures of Incorporation. This will be stated equally the purpose, in the following language:

The purpose of the corporation is to engage in the profession of [Description of Profession, east.g. Dentistry] and any other lawful activities (other than the banking or trust company business organisation) not prohibited to a corporation engaging in such profession by applicable laws and regulations. This corporation is a professional person corporation within the meaning of the California Corporations Code.

Part of the reason for this rule is that each profession has dissimilar requirements and restrictions. There is no 'General' Professional Corporation. Your company would be formed as a corporation specifically connected to one profession.

Are there exceptions to the single profession rule?

In order to increase success and acquirement, your profession may naturally seek to grade partnerships with other related professionals. A great example of this lies in the medical professions: a chiropractor may wish to share buying with a medical doctor, or a medical doctor may want to work with dr. assistants and registered nurses. All the same, if you are only allowed to reference one specialty, can you piece of work with these individuals under your own corporation?

The answer is yes, under the correct circumstances. There are unimposing and singled-out lists, available for each Professional person Corporation, which sets forth who may as well be shareholders or owners of that corporation.

For example, if a medical dr. wishes to form a medical corporation with other related medical professionals, that medical doctor may share ownership in the medical corporation with the following shortlist of related medical providers:

- (one) Licensed doctors of podiatric medicine.

- (2) Licensed psychologists.

- (3) Registered nurses.

- (4) Licensed optometrists.

- (v) Licensed matrimony and family therapists.

- (6) Licensed clinical social workers.

- (7) Licensed doctor assistants.

- (8) Licensed chiropractors.

- (9) Licensed acupuncturists.

- (10) Naturopathic doctors.

- (xi) Licensed professional clinical counselors.

- (12) Licensed concrete therapists.

- (thirteen) Licensed pharmacists.

Getting Started on Your Business: Fulfill All the Requirements to Correctly Form a Professional Corporation in California with Incorporation Chaser

With all the distinct and specific laws that revolve around your professional service and forming a professional corporation, you need an attorney who specializes not but in Professional Corporations but in your type of service!

Piece of work with us to course your specific professional corporation. Contact us today for communication on how to class your specific professional corporation or other legal questions relating to your professional corporation.

Are there specific name requirements for professional corporations?

Yes! Delight check out your corporation below to know more well-nigh naming your professional corporation

Do I Need A Registered Agent For My Corporation In California,

Source: https://www.incorporationattorney.com/california-attorney-professional-corporation-requirements

Posted by: georgedoons1973.blogspot.com

0 Response to "Do I Need A Registered Agent For My Corporation In California"

Post a Comment